The first few steps for generating electronic submission files are similar to those for generating printed reports: select the report, use the report filter to limit the records that will be included in the report, and click Submit. Electronic files require several additional processing steps, described below.

For example, to generate a vendor 1099-MISC electronic file with the property-management company as the payer, select 1099 MISC: Vendor > Payer: Management Co > Electr File Vendor by Management.

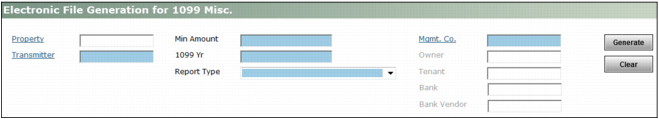

The Electronic File Generation for 1099 Misc filter appears. This filter works for all 1099 submission types: 1099-MISC, 1099-INT, and 1099-S.

|

1099-MISC 600

1099-INT 10

1099-S See IRS instructions or your accountant.

|

|

|

These options include the payer (vendor or owner). The payer must be the same payer for whom you extracted data. See “Payers” for additional information.

Electronic File Vendor By Mgmt. Co. Vendor 1099-MISC with the property-management company as payer.

Electronic File Vendor By Owner Vendor 1099-MISC with the owner as payer.

Electronic File Vendor By Mgmt. Co. Owner 1099-MISC with the property-management company as payer.

Electronic File Tenant INT By Mgmt. Co. Owner, tenant, and vendor 1099-INT with the property-management company as payer.

Electronic File Tenant INT By Owner Owner, tenant, and vendor 1099-INT with the owner as payer

Electronic File Tenant 1099-S Tenant 1099-S, with the management company as payer

Electronic File Vendor By Bank The 1099 batch includes data for one bank account, for situations where you want to generate separate batches by bank account--for example, if you use different bank accounts for property management and construction.

NOTE Although the INT menu items include “Tenant” in the name, they include data for anyone you paid interest: owners and vendors as well as tenants.

|

|

|

NOTE If you specify a tenant, the report excludes owners and vendors.

|

|

|

3

|

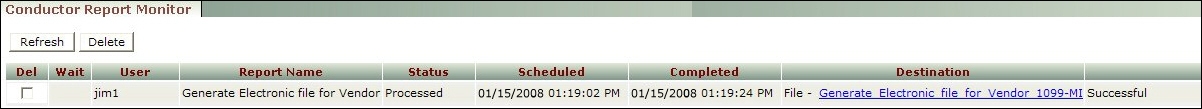

Click Generate.

|

Depending on the version of Internet Explorer you are using, you may see a File Download dialog box appears or a message asking whether you want to open or save the file. Click Save.

|

1099-MISC 600

1099-INT 10

|

|

|

4

|

Click Generate.

|