|

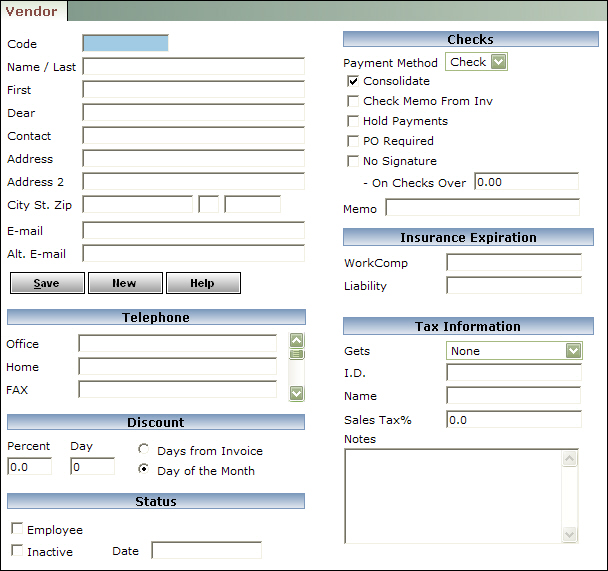

Do not use punctuation (for example, an apostrophe or dash) in the Name and Address fields of the transmitter vendor record.

|

For general information about adding a vendor record, see “Vendor Procedures” in the Core User's Guide.

|

1

|

|

The organization name associated with the federal tax identification number. If the organization name requires two lines, use the Address field for the second line. The name entered here must be the name associated with the federal tax identification number.

|

|

|

If the organization name requires two lines and, therefore, uses the Address field, type the address in the Address 2 field. If the organization name fits in the Name/Last field, use the Address field for the street address and leave the Address 2 field blank.

|

|

|

3

|

In the Memo field, in the Checks section, type the Transmitter Control Code (TCC) provided by the IRS.

|

|

4

|

Complete the following fields in the Tax Information section:

|

|

Select None.

|

|

|

5

|

Click Save.

|